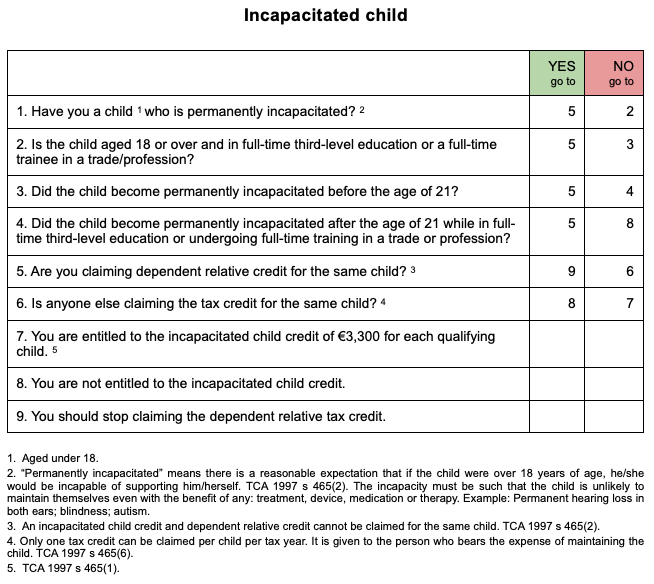

A parent of a child who is permanently incapacitated mentally or physically (i.e., a qualifying child) may claim for each such child a tax credit of €3,300. The child must be aged under 18 at the start of the tax year but the tax credit is also given in the case of a child, who, although aged 18 or over:

- is in third-level education on a full-time basis, or is undergoing full-time training in a trade or profession, or

- became permanently incapacitated before reaching the age of 21, or became permanently incapacitated after reaching 21 years of age while in third-level education or undergoing full-time training in a trade or profession.

A child is regarded as permanently incapacitated if there is a reasonable expectation that if the child were over 18 years of age, he would be incapable of supporting himself.

checklist