In general, a self-employed person can claim more deductions than an employee, providing more opportunity to reduce his tax bill. You can also claim capital allowances. On the other hand, you are exposed to greater risk if your business does not succeed.

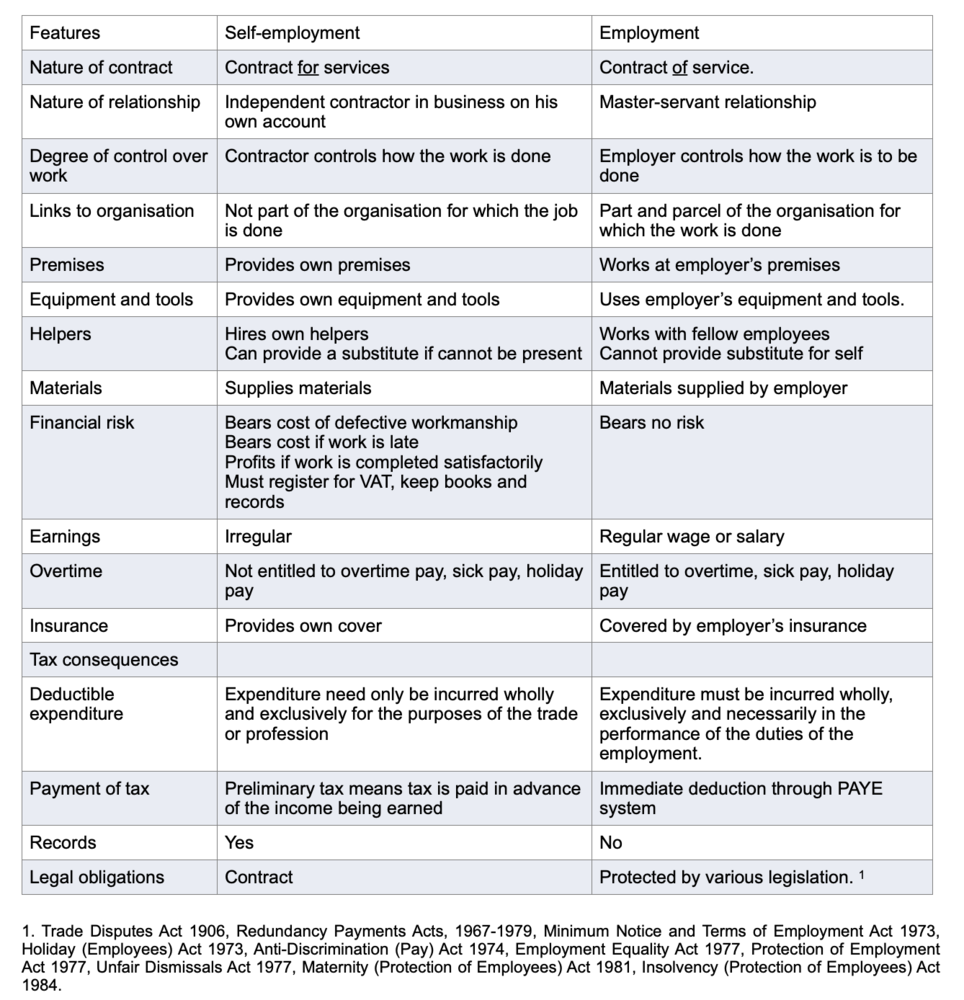

The following summarises the characteristics of employment and self-employment, and shows the tax consequences of each status.

Earnings of the following nature have been held to be income from an employment:

- Deep-sea dockers (who received a share of pooled earnings).

- A supermarket product demonstrator - even though her contract described her as an independent contractor.

- A part-time hospital consultant. His contract with the hospital was held to be a contract of service.

- Potato gang worker (as employees of the gang leader).

- An evening class teacher. The particular case concerned a full-time teacher who also taught adult evening courses.

- Part-time lecturers (where the lecturers were a hospital consultant, a non-practising barrister, and a professional singer). An individual who gives a once-off lecture, for example, once or twice a year to the same body, is not an employee. If he gives a series of “once-off” lectures to the same body, he is an employee.

An employer may prefer to have as few full-time staff as possible due to high overheads associated with employment. Many employers find they can save on PRSI and universal social charge by agreeing that staff change from employment in an office paid by salary to working from home paid by commission or per job. This type of arrangement may suit sales staff (who can be paid commission only, at a higher rate), programmers paid per assignment, typists paid per word, etc. You can use a tax-free termination payment to motivate an employee to change to the new self-employed arrangement. You cannot control how the employee does the work. You should not prevent the employee taking on work for other customers, as this indicates that the former employee is not genuinely self-employed.

Tip

The Report of the Employment Status Group contains a code of practice to be used by various government agencies in deciding whether an individual is an employee. The text may also be found on www.revenue.ie.

Traps

Converting an employee to a self-employed contractor is not a cosmetic accounting exercise to save PAYE/PRSI. The contractor must genuinely lose the benefits of employment, and must carry the financial risk of self-employment.

If a contractor is found to be an employee, the employer can be assessed for the PAYE/PRSI deductible from his salary.