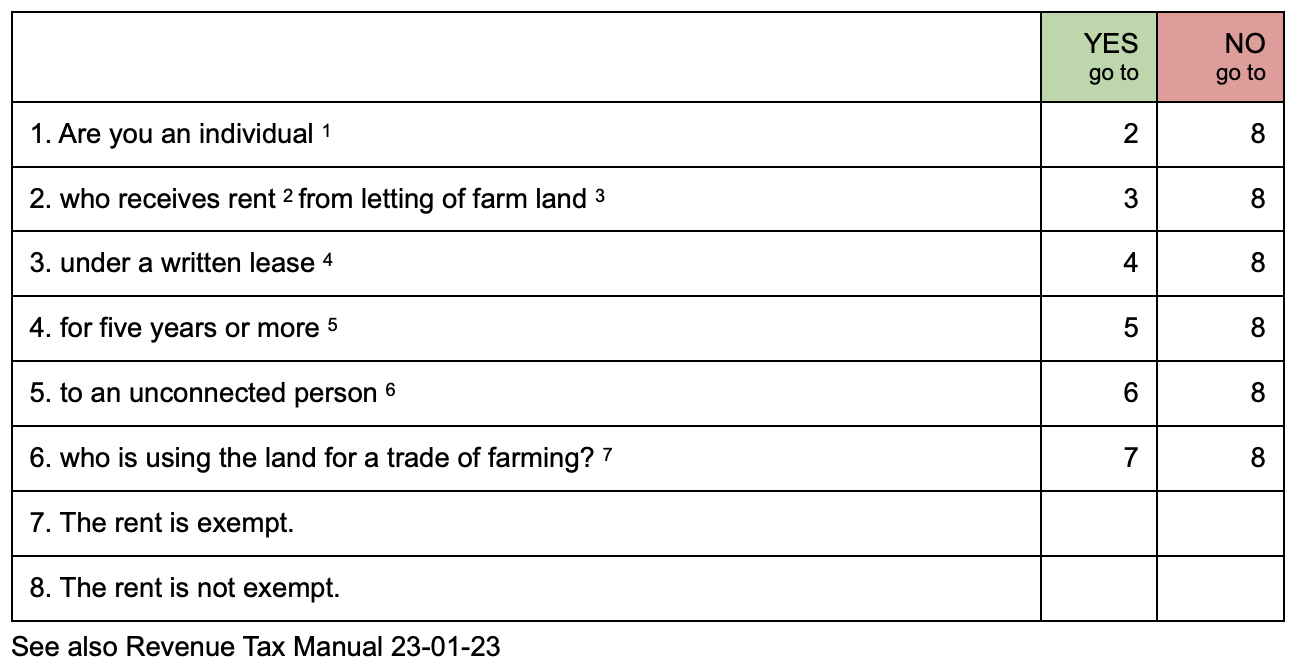

We are asked a lot of questions from #accountants and #taxadvisors about this on the taxworld members area. With regard to the #housingcrisis would it be too far of a stretch to extend a similar exemption to property landlords? How hard can it be?

1. Before 01.01.2015 the lessor needed to be aged 40 or over, or permanently incapacitated.

2. Rent includes a payment to compensate for the lessor for loss of EU Basic Payments.TCA 1997 s 664(7).

3. Land in the State wholly or mainly occupied for the purposes of husbandry and includes a building (other than a building or part of a building used as a dwelling) situated on the land and used for the purposes of farming that land.

4. If the lease relates to farm land and other property, only the part of the rent relating to the farm land is exempt TCA 1997 s 664(1).

5. If the lease is for a definite term of

- 15 years or more the exempt amount is €40,000, or the rent, for the year, whichever is lower,

- 10 to 15 years the exempt amount is €30,000 or the rent, for the year, whichever is lower,

- 7 to 10 years the exempt amount is €22,500 or the rent, for the year, whichever is lower,

- 5 to 7 years the exempt amount is €18,000 or the rent, for the year, whichever is lower,

- The figure is proportionately scaled back for a rental period of less than a full year’s letting.

6. You are connected (TCA 1997 s 10) with:

- your spouse (this includes civil partner),

- your relative (siblings, children, grandchildren, parents, grandparents),

- your relative's spouse,

- your spouse's relative, and

- the spouse of your spouse's relative,

- a company you control,

- a company controlled by your relative.

7. TCA 1997 s 664(1).