Written by Alan MooreAll articles

Preview - Introducing taxcademy - 200 hours CPD included in taxworld.ie membership

Posted on: 07 November 2022

Did you know?

As a taxworld.ie member, you can view almost 200 hours of recordings together with slides of past seminars and webinars.

In total there are almost 200 hours of recordings you can view.

These can be found by clicking on the "learn" tab on the left hand side menu (once you have logged in)

Each webinar is broken down, section by section, so you can view it piecemeal at a time that suits you.

Structured and unstructured CPD

Most professionals will have an annual CPD requirement of 30 hours composed of:

- 15 hours "structured" CPD which requires attendance at a live event with panel interaction, Q & A, etc.

- 15 hours self-certified CPD which is self-learning and development. This can involve viewing of recorded webinars.

If you already attended the live webinar, you qualify for "structured" CPD and you will already have received your cert along with access to the zoom recording.

If you have not attended the live webinar, you can self-certify your viewing of the online course as "unstructured" CPD.

You can also view other taxcademy webinars to make up your unstructured CPD requirement.

How do I view the taxcademy unstructured CPD webinars?

If you are not already a member, click here to join. We will invoice you.

If you are a member, log in:

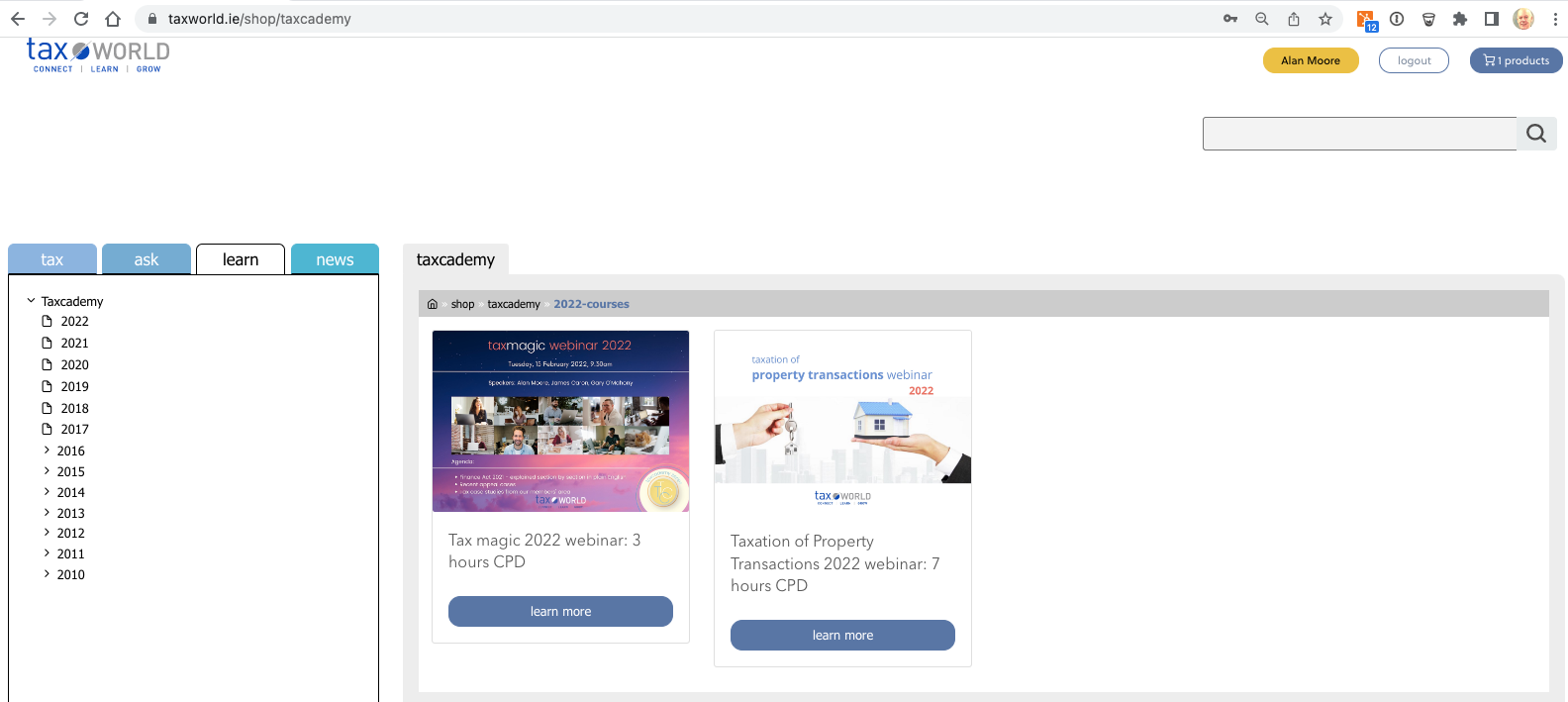

1. Go to https://www.taxworld.ie/shop/taxcademy

2. Click for example on "Taxation of Property Transactions 2022"

3. Click "Continue learning" and scroll down to see the modules:

4. Click, for example, on "Badges of trade":

You can now view the module and progress through the course.

To enable multiple individuals in your firm to self-certify, you will need to upgrade to enterprise membership.