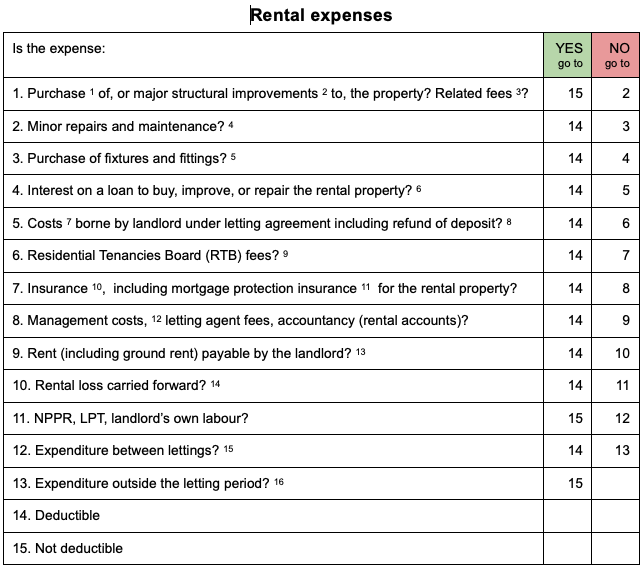

1. Capital expenditure on buying a property is not deductible unless the property is a “section 23” property, in which case the “construction” cost element of the purchase price could be deducted in year one: TCA 1997 s 372AP.

1. Capital expenditure on buying a property is not deductible unless the property is a “section 23” property, in which case the “construction” cost element of the purchase price could be deducted in year one: TCA 1997 s 372AP.

2. Expenditure on repairs (e.g. painting a room) is deductible but expenditure on major improvements (e.g., replacing the entire roof) is not deductible. Such enhancement expenditure is deductible for CGT purposes when you sell the property.

3. For example, legal fees and auctioneer fees. Deductible for CGT purposes when you sell the property.

4. For example, cleaning, painting, decorating, damp and rot treatment, plumbing, mending broken windows, doors, furniture and machines, replacing roof slates, boiler service, etc: TCA 1997 s 97(2)(d)

5. For example, carpets, curtains, beds, furniture, kitchen appliances, mattresses, TV, new boiler, security system, etc. You get a 12.5% annual allowance E.g. for a tv costing €800 the wear and tear allowance is €100 p.a for eight years.

6. Since 01.01.2019 there is no restriction on interest on a loan to buy improve or repair a residential property. Before that 2018 (85%), 2017 (80%),08.04.2009 to 31.12.2016 (75%), Pre 07.04.2009 (100%), TCA 1997 s 97(2)(e), (2J). There is no deduction for interest in respect of a property bought from your spouse (from 06.02.2003) TCA 1997 s 97(2G) unless in the curse of separation or divorce proceedings TCA 1997 s 97(2H)

7. Rates, gas, electricity, heating, telephone, internet, cable TV, water, bin collection:,TCA 1997 s 97(2)(c). No deduction for expenses claimed by another person for tax purposes: TCA 1997 s 97(3)

8. Rental deposit is treated as rental income. Therefore, any refund of the deposit is deductible.

9. Mortgage interest is not deductible unless the property is registered with RTB: TCA 1997 s 97(2I). The cost of late registration with RTB is not deductible.

10. TCA 1997 s 97(2)(d).

11. IT 70 Guide to Rental Income.

12. TCA 1997 s 97(2)(d).

13. TCA 1997 s 97(2)(a).

14. TCA 1997 s 384(1)-(2). Capital allowance must be deducted before rental losses: TCA 1997 s 384 (4).

15. E.g., advertising, legal fee for negotiating a lease). Provided the property is not occupied by the landlord during the period: TCA 1997 s 97(3).

16. For pre-letting expenditure in relation to a vacant property first let before 31.12.2021, up to €5,000 is allowable: TCA 1997 s 97A(2); clawback if the property ceases to be let within 4 years of first letting: TCA 1997 s 97A(5).