Written by Alan MooreAll articles

Small Companies Administrative Rescue Process (SCARP)

Posted on: 30 September 2022

We have updated our Companies Act 2014 with the new Part 10A (ss 558A-558ZAJ), which was added by the Companies (Rescue Process for Small and Micro Companies) Act 2021. We've also added the commentary and the accompanying Revenue manual.

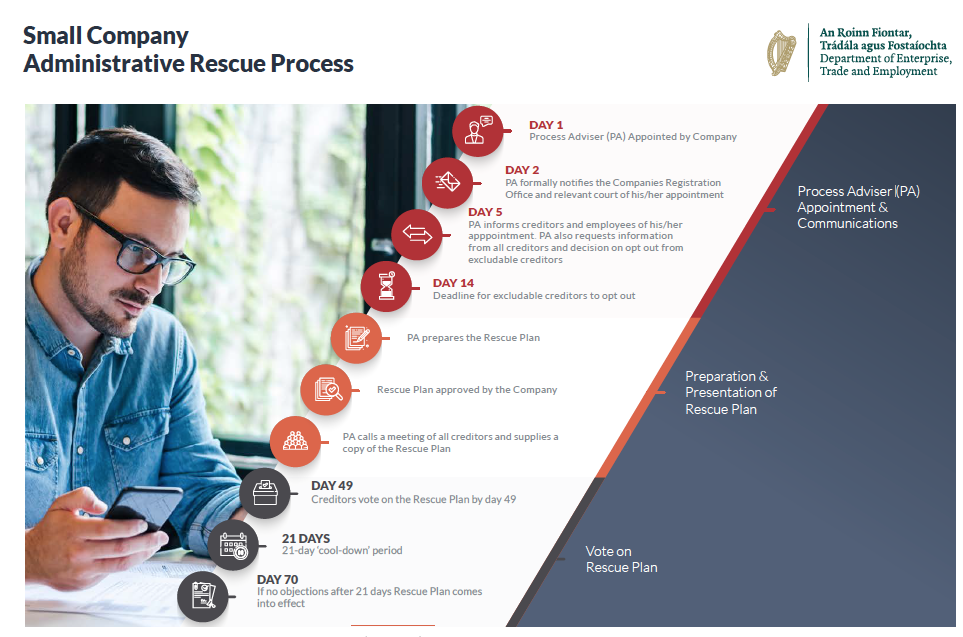

The Small Companies Administrative Rescue Process (SCARP) which was introduced on 8 December 2021, provides a rescue process for small and micro companies in financial difficulties.

To qualify, a company must be a small or micro company, i.e., one which meets two of the following three conditions:

- No more than 50 employees,

- Turnover must not exceed €12 million, and

- Balance sheet must not exceed €6 million.

The company must be unable to pay its debts.

The company must not be in liquidation.

It must not have appointed an examiner or Process Adviser in the previous 5 years.

If a receiver has been appointed to the company, the company is eligible only if that receiver has been appointed for a period of less than 3 working days.

The process advisor, the insolvency adviser appointed by the company to oversee the process, must determine that the company has a reasonable prospect of survival.