Written by Alan MooreAll articles

taxworld update 17 August 2023 - amazing new features

Posted on: 17 August 2023

|

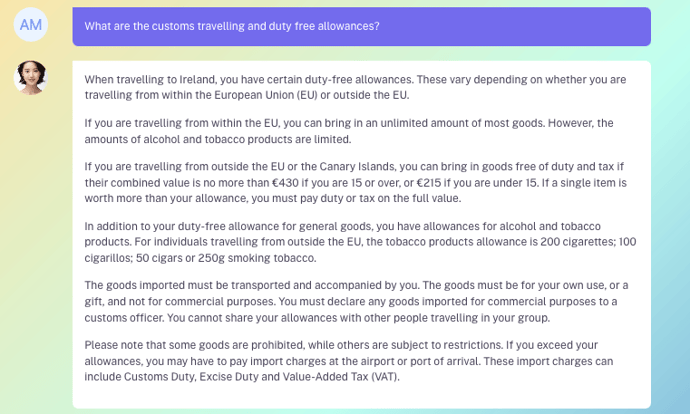

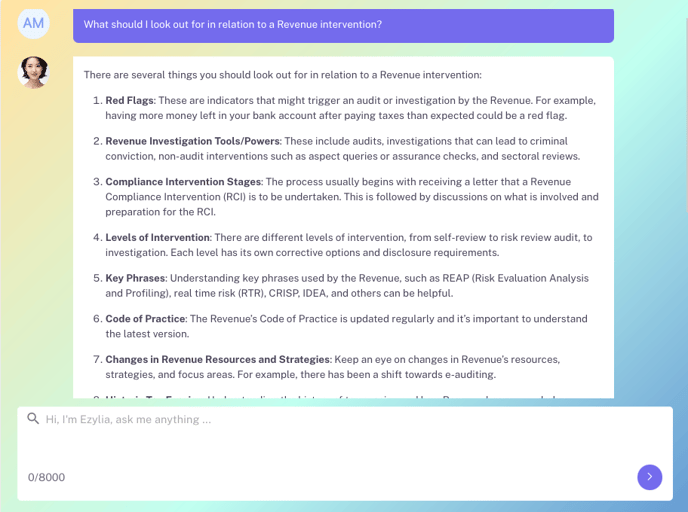

This is just to let you know what's been updated on www.taxworld.ie in July 2023. Apart from being able to answer questions and write client letters in relation to income tax, corporation tax, capital gains tax, VAT, capital acquisitions tax, stamp duties, vacant homes tax, residential zoned land tax, and the defective concrete products levy... Ezylia can now answer questions relating to customs and also excise! |

What is natural gas carbon tax and what are the rates?Natural Gas Carbon Tax (NGCT) is a tax imposed on the carbon content of natural gas. The rate of NGCT is proportionate to the amount of CO2 emitted when natural gas is combusted. The supplier of natural gas is liable for the payment of this tax. A liability to the tax arises when natural gas is supplied in the State by a supplier to a consumer. Self-supply of natural gas for a supplier’s own consumption is also liable. The rates for Natural Gas Carbon Tax are as follows:

What steps do I need to take to get a publican's licence?To get a Publican’s Licence, you need to follow these steps:

Please note that the waiver of Excise Duty on on-trade liquor licences will not be extended to renewals in 2022. What are the customs rules relating to moving to live in Ireland from outside the EU?If you are moving from outside the European Union (EU) to take up your normal residence in Ireland, you may be able to claim relief from Customs Duty and Value-Added Tax (VAT). This relief applies to imports of certain personal property, including used clothing and household effects, including those of members of your household. However, there are certain conditions you must meet:

Small consignments may be examined at the place of importation. Larger consignments may be examined at your premises, or other suitable location. You must apply in writing for this to Revenue at the point of importation. Any cost arising is your responsibility. Upcoming AI webinar 09:30 8 September 2023 - One hour CPD - free! |

Meet Ezylia, your new tax assistant!Ezylia can summarise tax topics, write client letters, answer questions. The list is endless. Learn more: read the brochure - watch the video - €96 + VAT monthly for non-members. If not completely satisfied you can cancel after one month. Member sign up: just reply to this email with the word "upgrade". It is €48 + VAT per month. |

|

Alan Moore